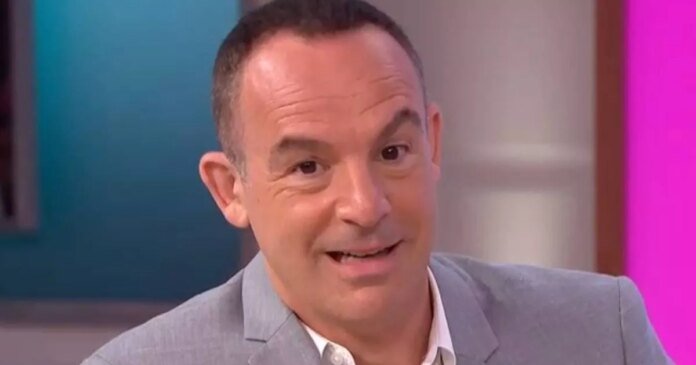

A supporter of Martin Lewis shared her experience of successfully reclaiming over £31,000 from HMRC by following his guidance.

The individual, identified as Cilla, had been receiving an incorrect amount of state pension for 15 years due to an issue with an outdated form of National Insurance credits called Home Responsibilities Protection (HRP).

HRP was intended to lower the required number of qualifying years for the state pension, but an investigation uncovered that many individuals, particularly women who had taken time off work to care for family, had not received the appropriate level of HRP on their National Insurance records.

The problem stemmed from Child Benefit claim forms submitted prior to 2000 that did not include National Insurance numbers, resulting in HRP not being accurately applied to the records.

If you applied for Child Benefit between 1978 and 2000, you may be affected by this oversight as your National Insurance record determines your future state pension amount.

Missing out on HRP could lead to gaps in your National Insurance record, potentially resulting in a reduced state pension entitlement.

HRP was replaced by National Insurance credits in 2010. Cilla, a reader of MoneySavingExpert.com, shared her successful experience in reclaiming backpay by contacting HMRC.

Recent data from HMRC indicates that 370,000 women have been notified about potential underpayments, with an average reimbursement of £7,859 per person by the DWP.

HMRC identified 5,344 cases of underpayments totaling around £42 million between January 8 and September 30, 2024. It is estimated that 43,000 affected individuals have passed away, but their families can still claim on their behalf, with priority given to those over pension age.

If you suspect you may have missed out on HRP, it is advisable to review your state pension and National Insurance record. Any gaps in your National Insurance record from 1978 to 2010, especially if you had caregiving responsibilities during that period, could indicate a missing HRP.

To claim missing HRP, you can utilize the online service on GOV.UK or fill out a form and send it to HMRC by post.